audit vs tax big 4

Overview of Big 4 Audit Roles Big four audit will pay less in the beginning. Audit is a type of role which a person will see the world differently.

Big 4 Audit Firms Kpmg Deloitte Ey And Pwc Analytics Steps

Audit - Asking for loads of paperwork and data and messing around in excel for a month.

. Audit is way better. Are you interested in a career in accounting but dont know whether to choose Tax or Audit. A Big 4 consultant may exit to MBB while a TAS may exit to BB IB.

Exit Opportunities - Audit vs. Big 4 Accounting- Audit vs. Ziphoblat 4 hr.

Big 4 Tax vs Audit Question. Hopefully I can help you unders. Which practice is better for you Audit or Tax.

Today we will be covering the pros and cons of working in audit or tax accounting at the big 4 accounting fir. Hey folksIn this video I want to address a question I once had when deciding which career path to choose within the Big 4. Ive heard from several that it is much easier to go from Audit to Tax than Tax to Audit.

Which practice is better at the big 4. As a Tax Manager at one of the Big 4 Ive been happy with my dec. Ago Depends entirely on your specialism.

One caveat is that many firms will not hire undergrads directly into their TASFAS groups. May 29 2012 at 412. In the big 4 there are very exceptional professionals and.

How do the exit opportunities vary between tax and audit positions. On average how hard is it to switch out of Big4 Tax after a couple years into a corporate accountingfinance role in private vs if you were in audit. The key difference between the two is that tax will likely lead to more tax roles.

If youre trying to decide whether an audit or tax career is right for you consider the pros and cons of each path. In this weeks video I will. I have heard that people have better luck finding and exit route out of Big 4 in audit.

If youre trying to decide whether an audit or tax career is proper for you consider the pros and cons of each. I work in tax and could transfer. Tax is more specific to jurisdiction so you cant transfer across world.

Both supply such services to companies. Tax- figuring out ways for corporates to get out of their obligations multiplying profit by the tax rate. The market isnt nearly as big for problem.

A career in audit can also lead to a lucrative future with great livability but it doesnt come without its obstacles. Big 4 Accounting- Audit vs. In this video I wont tell you If you are an introvert go into tax and if you are an extrovert go into audit Because this is just not that simple.

Both tax and audit are within a big four. After Big 4 once youre the tax guy youll always be the tax guy.

Big 4 Transaction Services Careers Recruiting And Exits

:max_bytes(150000):strip_icc()/bigfour_final-e4d14c89bfa84d4d91d73b86d09671da.png)

What Are The Big 4 Accounting Firms Definition And Critique

A Cpa S Journey From External Audit To Internal Audit To Tax Gleim Exam Prep

Audit Tax Advisory How To Choose A Specialism In Practice Cruncher Ie

Which Big 4 Firm Makes More From Consulting Than Audit And Tax Combined Going Concern

Who Makes Partner In Big 4 Audit Firms Evidence From Germany Sciencedirect

5 Reasons To Choose Tax Over Audit Big 4 Tax Manager Youtube

Deloitte Ey Kpmc And Pwc Everything You Need To Know About The Big Four Consultants

Big Four Earn Bulk Of Audit Fee From Nse Firms Business Standard News

How To Choose Between Tax Or Audit Big 4 Accounting Firms Kpmg Deloitte Ey Pwc Youtube

Accounting Firms Top 10 Accounting Firms Across The Globe

Why The Rise Of Partners In Big Four Accounting Firms Is Not As Dazzling As You Might Think The Economic Times

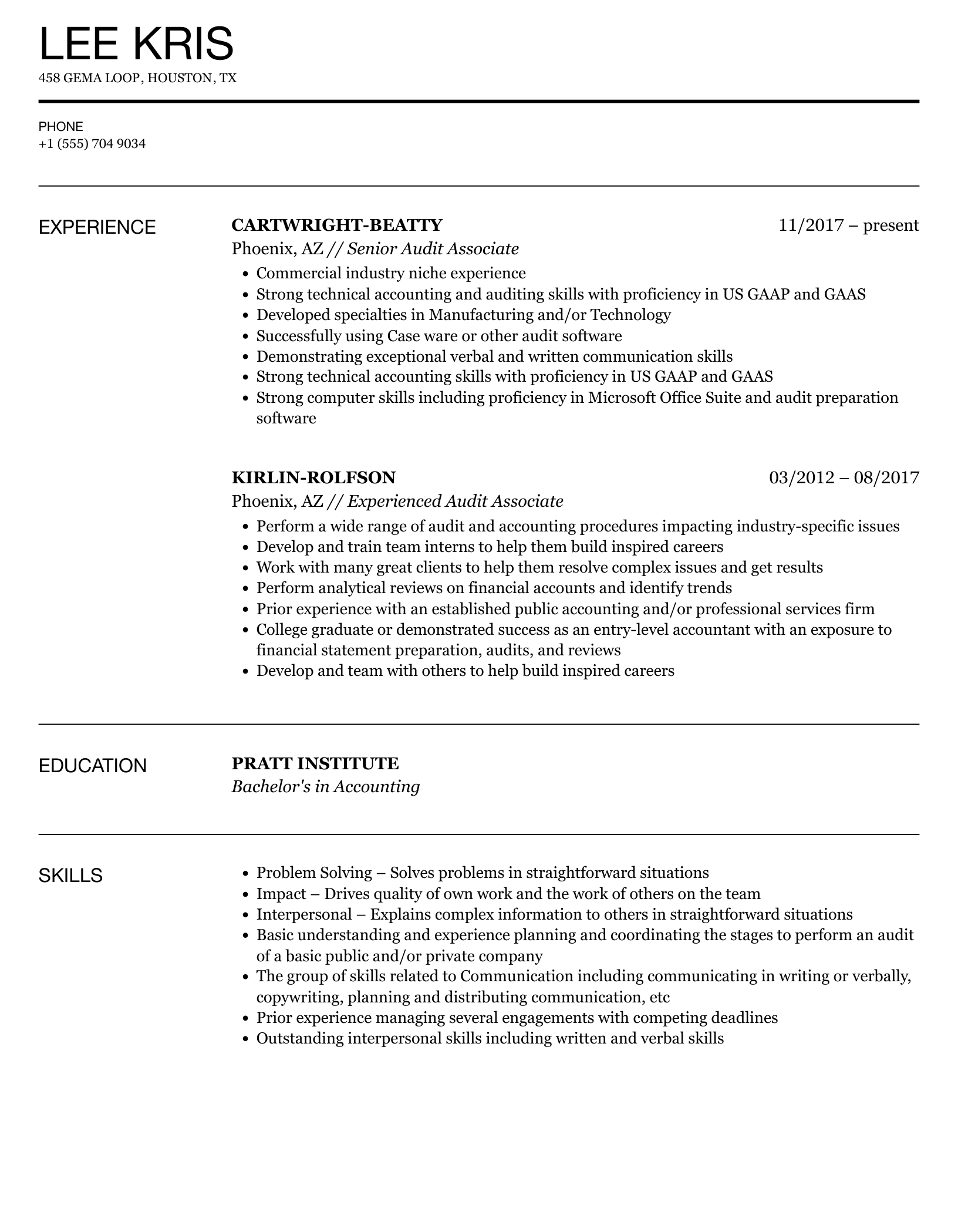

Audit Associate Resume Samples Velvet Jobs

Audit Vs Assurance Top 5 Best Differences With Infographics

Mconsultingprep 𝗛𝗢𝗪 𝗧𝗛𝗘 𝗕𝗜𝗚 𝗙𝗢𝗨𝗥 𝗙𝗜𝗥𝗠𝗦 𝗖𝗔𝗠𝗘 𝗔𝗕𝗢𝗨𝗧 The Big 4 Firms Deloitte Kpmg Pwc And Ey Are The Four Largest Professional Service Networks In The World Offering Services

Ey Vs Kpmg Internship Offer R Accounting