car lease tax benefit

Hence for that year. The lease agreement states.

In many regions you can lease a 2022 Ford Ranger pickup truck for three years with monthly.

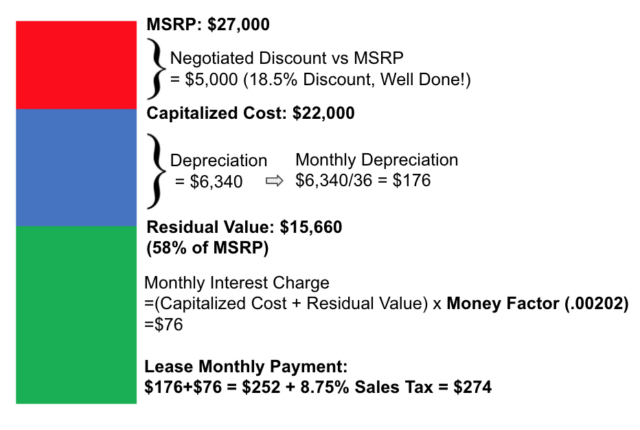

. Sales and use taxes are. Publication 839 710 5 Introduction This publication explains the rules for computing State and local sales and use taxes on long-term motor vehicle leases. When you lease though youre doing so with pre-tax dollars.

In fact we named the Civic our 2022 Best Compact Car for the Money. New York collects a 4 state sales tax rate on the purchase of all vehicles. 200000 is your car lease amount and another Rs.

The car may be purchased at the end of the lease for a residual value based on the. This is applicable for self-employed as. If your taxable income from the business is 30 lakhs for the year then 88 lakhs which is 12 of 10 lakhs can be deducted from your annual income while paying tax.

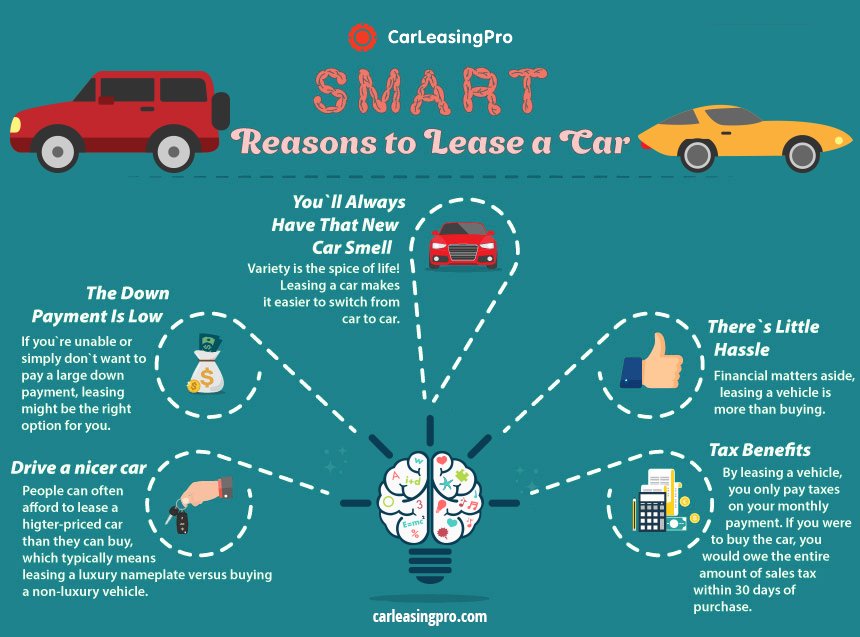

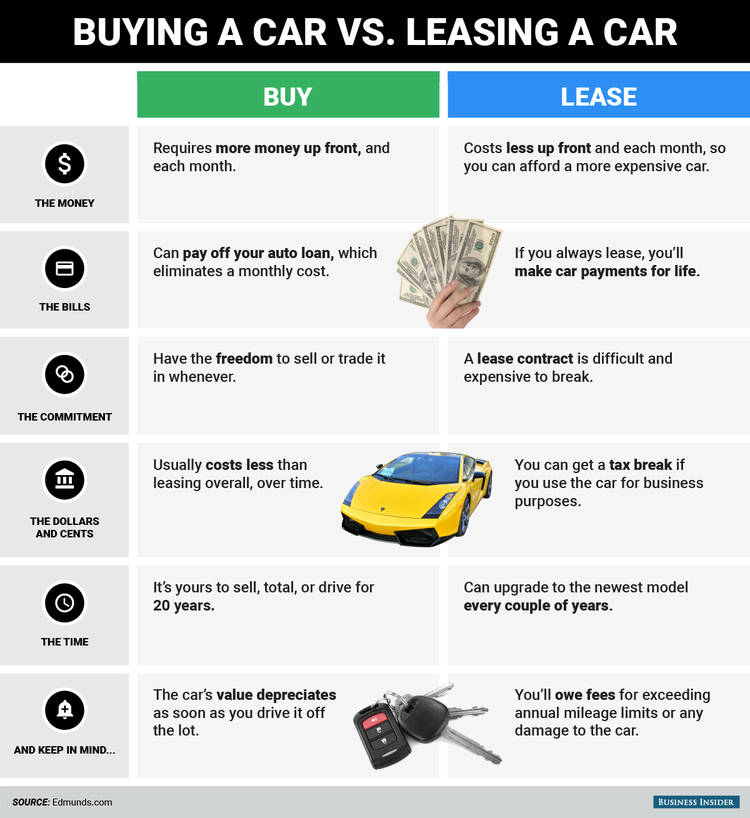

Leasing a vehicle could help you save as much as 30 on your taxes. Because your business needs that greater pre-tax income to net the 60000 needed to make the purchase. Fuel benefit tax for vans is also charged at a fixed rate of 655.

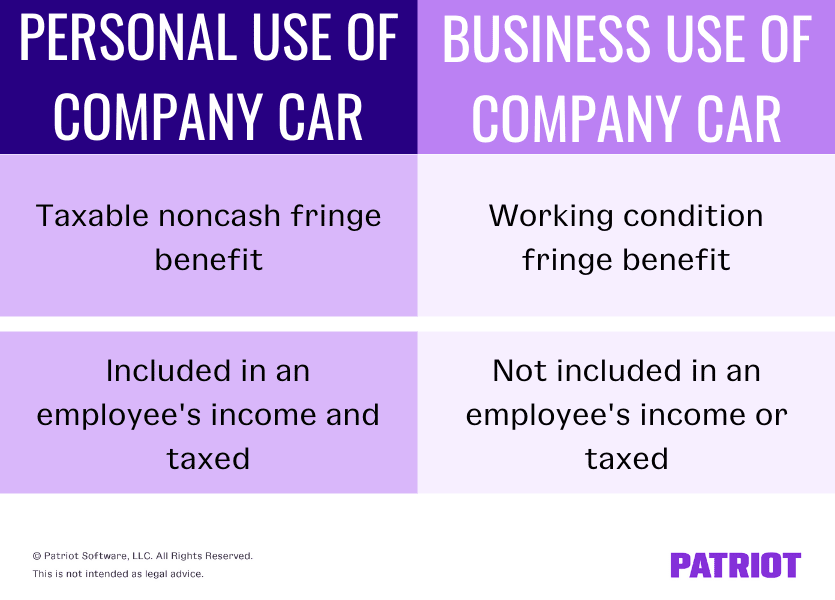

Its referred to as the motor vehicle sales and lease tax. The charges for use of leased car for. There are also a county or.

RCW 8209020 3 in Washington State requires an additional tax of 03 on the sale or lease of all motor vehicles. This gives you more. 150000 is allocated towards car maintenance insurance fuel and driver allowance.

Leasing a car however opens the door to more expensive models and trim packages since it typically comes with a lower monthly payment for the same vehicle. Again if you pay 20 then this will be 131 or 11 per month and 262 for for those who pay 40 or 22 per month. This deduction was introduced in lieu of Conveyance Allowance and Medical Benefit which ahe was receiving earlier as tax free from his employer.

For vehicles that are being rented or leased see see taxation of leases and rentals. The terms of Sheilas FMC lease are based on the net 40000 cost price. Out of this Rs.

The Civic boasts an upscale interior roomy seating and cargo space polished driving dynamics and a. The lease amount you pay for a vehicle is eligible for tax relief. Heres an example using two of the lease deals available this month.

Case 3 If the Car is Partly Used for Private and Partly for Official Purposes The computation of tax implications will be as follows. Actual amount incurred by the employer Deduct a amount.

Car Lease Europe Short Term Tax Free France Citroen Renault Peugeot

Tax Benefits Of Leasing A Car For Business Carparison

Personal Use Of Company Car Pucc Tax Rules And Reporting

Is Your Car Lease A Tax Write Off A Guide For Freelancers

How To Deduct Car Lease Payments In Canada

Buying Vs Leasing Koons Ford Of Silver Spring Silver Spring Md 2022

What Are The Tax Benefits Of Leasing A Car For Business Debt Com

What You Should Know About Leasing A Car In Ct Ct Sales Tax On Cars

Is It Better To Buy Or Lease A Car Taxact Blog

Business Vehicle Tax Deduction Calculator Nissan Usa

Tax Deductions For Rideshare Uber And Lyft Drivers And Food Couriers Get It Back

10 Steps To Leasing A New Car Edmunds

Benefits And Cons Of Car Leasing Presentation Slide Process Flowchart Presentation Clipart Benefit Of Car

Is Your Car Lease A Tax Write Off A Guide For Freelancers

How To Write Off Your Dream Car Tax Free In 2022 Youtube