tax credit survey mean

Created in 1981 to stimulate research and development RD in the United States the RD tax credit is a dollar-for-dollar offset of federal income tax liability and in certain circumstances payroll tax liability. They too prefer to do business with a national bank 28.

Work Opportunity Tax Credit What Is Wotc Adp

A little less than 5 of the people polled in the survey the smallest of any group qualified for the credit but opted out.

. The survey found that 26 of people ages 18 to 24 use credit unions while 36 of people in this age group opt for national banks such as Chase Bank of America US. Those who didnt however are. Many homeowners think they are not eligible for the solar tax credit because they dont have an additional tax bill at the end of the year.

The results of the study prove what common sense probably already led you to believe that the vast majority of households took the credit as an advance because they needed the money. Last year more than. The federal solar tax credit is the most popular financial incentive for homeowners looking to go solar.

The Disability Tax Credit DTC is a non-refundable tax credit created by the Canadian Government and Canada Revenue Agency CRA and its purpose is to reduce the amount of income tax Canadians with disabilities andor their families and supporters would have to pay annually hence assist with the various financial implications and expenses of having a. You usually multiply the number. Child Tax Credit Update.

New Markets Tax Credit Low-Income Community Census Tracts - American Community Survey 2011-2015 November 2 2017New Markets Tax Credit 2011-2015 American Community Survey Census Transition FAQs October 30 2017During the one-year transition period both sets of data will be available in in the NMTC Mapping ToolThe new 2011-2015 data is displayed by default. What the numbers mean The numbers in an employees tax code show how much tax-free income they get in that tax year. Most states provide a similar credit making the average potential benefit of the federal and state credit in the range of 10-20 of qualified spending.

People between the ages of 25 and 34 are even less likely to use a credit union with only 14 being members of one. The 26 tax credit is a dollar-for-dollar reduction of the income tax you owe. Bank and Wells Fargo.

The last two years tax filing was confused and delayed by the pandemic with the IRS also forced to oversee various relief programmes like.

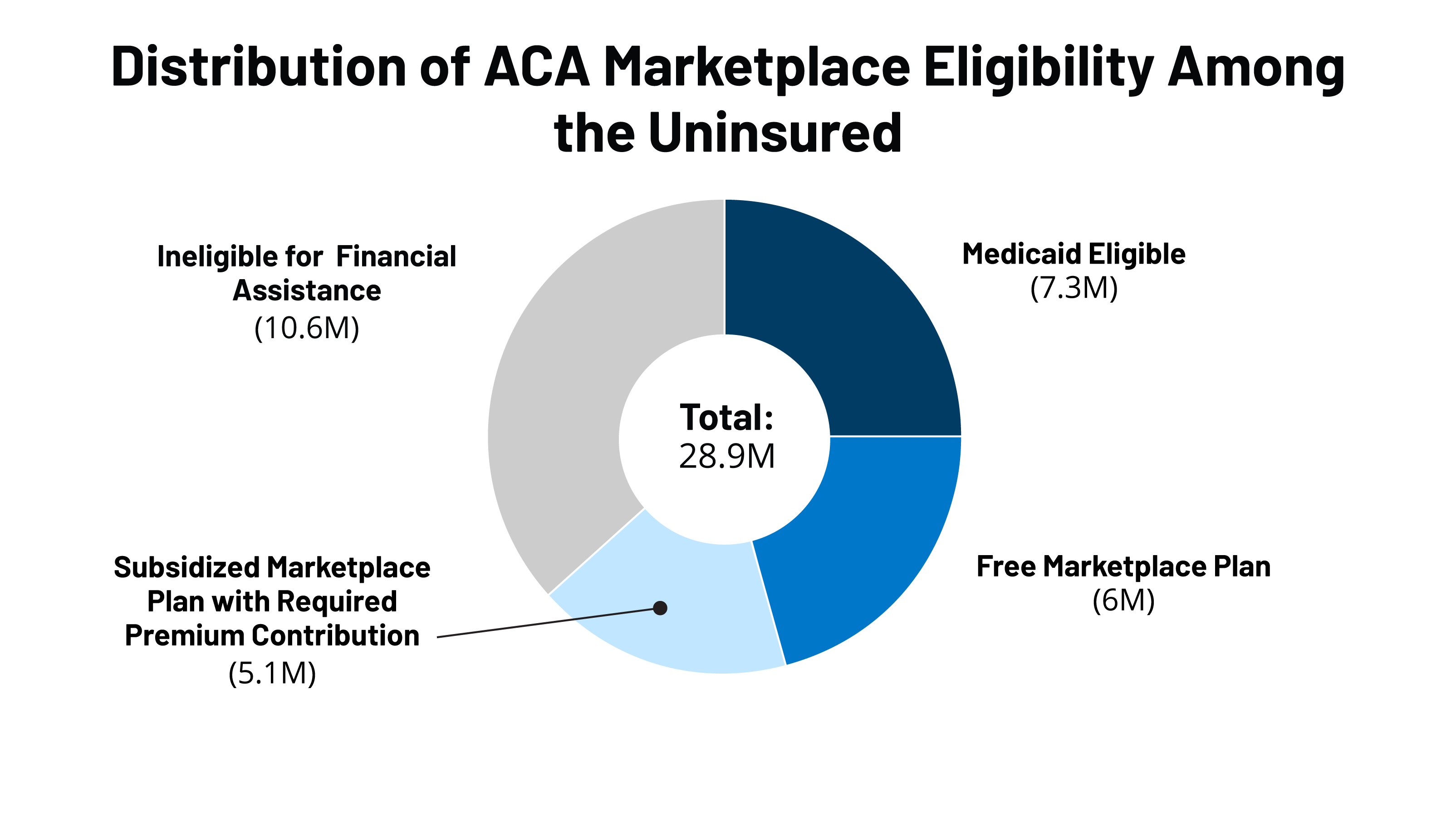

How The American Rescue Plan Act Affects Subsidies For Marketplace Shoppers And People Who Are Uninsured Kff

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Work Opportunity Tax Credit What Is Wotc Adp

Low Income Housing Tax Credit Ihda

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

The 2021 Child Tax Credit Implications For Health Health Affairs

Tax Refund 2022 4 Errors That Could Delay Your Tax Refund Deseret News

Closing Costs That Are And Aren T Tax Deductible Lendingtree

The 2021 Child Tax Credit Implications For Health Health Affairs

The Case For Forgiving Taxes On Pandemic Unemployment Aid

Child Tax Credit United States Wikipedia

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

The Anti Poverty Targeting And Labor Supply Effects Of The Proposed Child Tax Credit Expansion Bfi